Donation Valuation Guide: How to Price Used Items

When donating used items, determining their Fair Market Value (FMV) is key for tax deductions and staying compliant with IRS rules. FMV is the resale price an item would fetch between a willing buyer and seller. Here’s what you need to know:

- You’re responsible for valuations, not the charity. Overvaluing can lead to IRS penalties (20–40%), while undervaluing means missed deductions.

- Condition matters. Items must generally be in "good used condition or better" to qualify.

- Documentation is required. Examples include receipts for donations under $250 or Form 8283 for items exceeding $500.

- AGI limits apply. Charitable deductions are capped at 60% of your Adjusted Gross Income.

To value items:

- Record details. Note the brand, condition, and original cost.

- Research prices. Check thrift stores, consignment shops, or online sales.

- Adjust for condition. Consider wear, demand, and age.

For example:

- A sofa might range from $36–$395.

- A coffee maker could be $4–$16.

Tracking tools like Deductible.me can simplify valuations, store records, and generate IRS-compliant reports for just $2/month.

Accurate valuations ensure you maximize deductions while avoiding penalties.

How Do I Value My Donated Items To The IRS? - CountyOffice.org

IRS Rules for Valuing Donated Items

When it comes to claiming deductions for donated items, the IRS has clear guidelines to ensure accuracy and compliance. These rules outline how to determine the value of your donations, what kind of documentation is required, and when you might need a professional appraisal. Following these guidelines is essential to avoid penalties and make the most of your charitable contributions.

What Fair Market Value Means

Fair Market Value (FMV) isn’t about what you originally paid for an item or what it would cost to replace it today. Instead, it’s the amount someone would pay for the item at the time you donate it. Essentially, it’s the going rate in a resale setting, like a thrift store or consignment shop [1].

For instance, a microwave that originally cost $150 might now be worth between $10 and $50, depending on its condition. Similarly, a used men’s shirt or a sofa would be valued based on current secondhand market prices [2].

Condition Standards and Documentation Thresholds

The IRS has specific standards for the condition of donated items. Clothing and household goods must generally be in “good used condition or better” to qualify for a deduction [1]. Damaged items typically don’t qualify unless their value exceeds $500. In such cases, you’ll need a qualified appraisal to back up your claim [1].

The documentation requirements vary based on the amount of your deduction:

- Under $250: A receipt from the charity with details like its name, the date, location, and a description of the donated items [1].

- $250 to $500: A written acknowledgment from the charity [1].

- Over $500: A written acknowledgment plus Form 8283 (Section A) [1].

- Over $5,000: A written acknowledgment, Form 8283 (Section B), and a qualified appraisal [1].

For art donations, the rules become even stricter. If the value of your donated artwork is $20,000 or more, you must include a qualified appraisal with your tax return. For artwork appraised at $50,000 or more, you can request a “Statement of Value” from the IRS for a $7,500 user fee, which covers up to three pieces [1].

In addition to these requirements, your deductions are also subject to limits based on your adjusted gross income (AGI).

AGI Limits on Charitable Deductions

The IRS caps total charitable deductions at 60% of your AGI, though this limit can drop to 20%, 30%, or 50%, depending on the type of donation and the organization receiving it [4].

For example, if your AGI is $100,000, you can deduct up to $60,000 in charitable contributions for that year. Accurately valuing your donations is key - overestimating could push you beyond these limits unnecessarily, while underestimating might mean missing out on deductions.

Valuation errors come with serious consequences. The IRS may impose a 20% penalty for substantial valuation misstatements [4][1] and a 40% penalty for gross valuation misstatements [4][1]. So, ensuring your valuations are accurate isn’t just about maximizing deductions - it’s also about avoiding costly penalties.

How to Value Used Items: Step-by-Step

Figuring out the fair market value of a used item boils down to three main steps: gather details, research comparable prices, and adjust for condition and demand.

Record Item Details

Start by jotting down all the key details about your item. Include the brand, model, style, size, original purchase price, purchase date, and age. Be thorough when noting the condition - mention any wear, missing parts, or defects. If there’s noticeable damage or imperfections, document those too. And don’t forget to snap a few clear photos to visually back up your item's condition.

"If you would give it to a relative or friend, then the item is most likely in good condition and is appropriate to donate." – Goodwill Industries

Once you’ve got this information, you’re ready to compare your item to similar ones to gauge its market value.

Find Comparable Prices

The next step is researching what similar items are selling for. For electronics or tech, focus on recent "sold" listings on platforms like eBay - asking prices can be misleading. For instance, a laptop that originally retailed for $1,500 might now sell for around $500 if it’s a year old and in good shape.

When it comes to clothing or household goods, check thrift stores, consignment shops, or guides from organizations like the Salvation Army or Goodwill. Some tax software even includes estimated values based on thrift store sales and online auction data, which can be a handy resource.

Adjust for Condition and Market Demand

Finally, refine your valuation by factoring in the item’s condition and how desirable it is. Even if something works perfectly, outdated styles or older technology can drag down its value. Stick to IRS condition standards when making these adjustments.

Rarity and demand also play a big role. For example, a first-edition book in excellent condition could fetch far more than a damaged copy. Avoid relying on prices from liquidation or forced sales, as those don’t represent fair market conditions. Instead, use prices from regular transactions where both buyers and sellers have freedom in the deal.

Valuation Guide by Item Category

Using the valuation steps outlined earlier, these category-specific tips can help you determine fair market values for different types of items. Each category is assessed based on these principles, with adjustments for unique market factors.

Clothing and Accessories

When it comes to used clothing, the value is often much lower than the original purchase price. The IRS defines fair market value (FMV) as the price a buyer and seller would agree upon willingly. In practical terms, you can use prices from local thrift shops or consignment stores as a guide [1]. However, there’s no one-size-fits-all formula - factors like brand, condition, and style trends play a significant role. For example, a well-maintained designer coat will generally be worth more than a generic jacket showing signs of wear.

Furniture and Household Goods

Pricing furniture accurately not only maximizes your potential deduction but also helps you stay compliant with IRS guidelines. Furniture values can vary significantly depending on condition and current trends. For instance:

- A sofa might range from $36 to $395

- Coffee tables typically fall between $15 and $100

- A complete dining room set could range from $156 to $934

- Dressers are usually valued between $20 and $104 [2][3]

For larger pieces, you can use the replacement cost method. This involves comparing the price of a new item and subtracting depreciation for wear and age [1]. Keep in mind that furniture that’s out of style may have little market value, even if it’s in good condition. For household goods like coffee makers (valued at $4 to $16), vacuum cleaners ($5 to $67), and lamps ($6 to $52), checking thrift store prices can also be a reliable way to estimate value [2][3].

Electronics and Appliances

Electronics tend to lose value quickly due to constant advancements in technology. A working laptop or TV that’s a few years old may have limited market value because newer models dominate the market [1]. In fact, technological obsolescence often affects value more than physical condition. To get accurate estimates, check recent online sales and adjust for depreciation [1][6]. For both electronics and appliances, thrift store prices often provide a good benchmark [6]. It’s important to base the value on the item’s condition at the time it’s donated - not on what the charity might sell it for later [6].

sbb-itb-e723420

Documentation and Recordkeeping Requirements

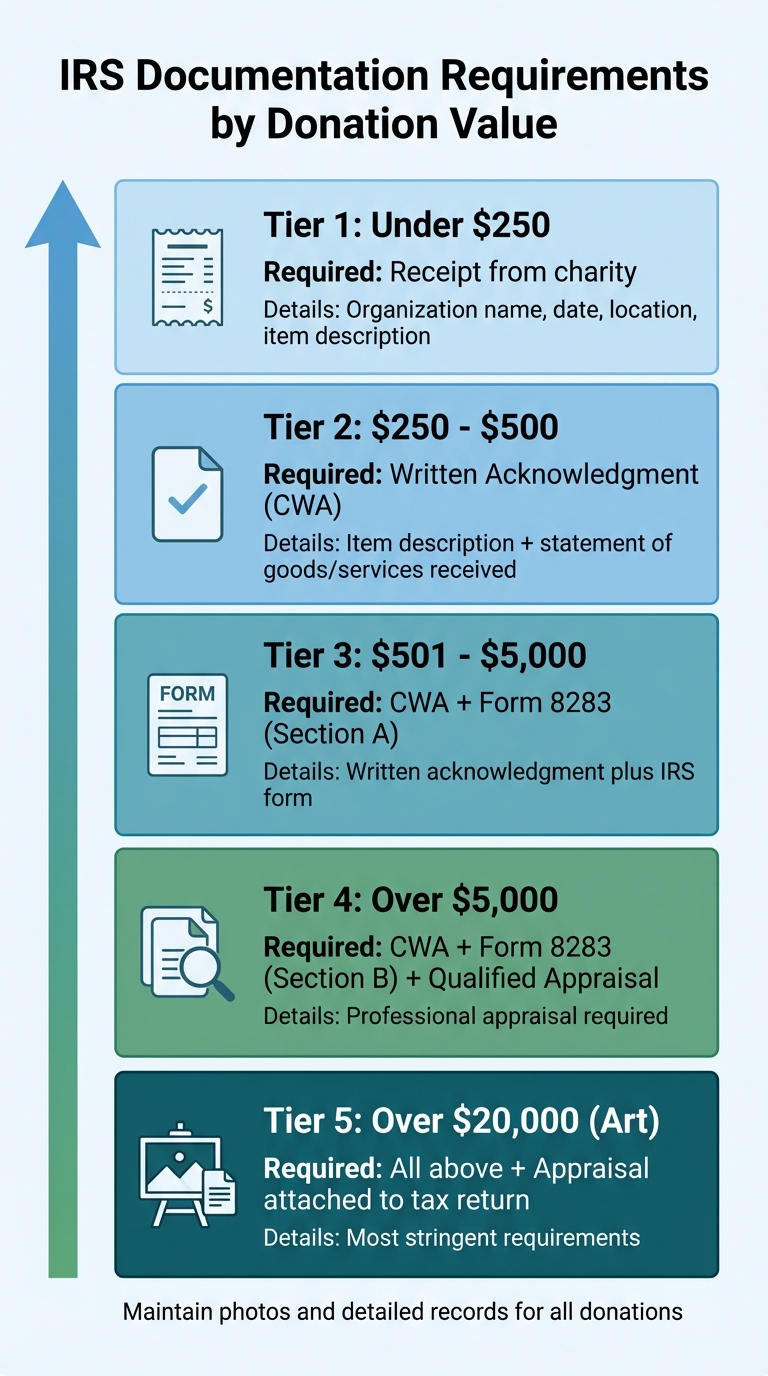

IRS Documentation Requirements by Donation Value

Maintaining detailed records is crucial to support your deductions in case of an IRS review. The type of documentation you’ll need depends on the value of your donation. As the donation amount increases, the IRS requires more detailed proof.

What to Document at Each Value Threshold

For non-cash donations, the IRS sets specific recordkeeping rules based on the total value of your contribution:

| Donation Value | Required Documentation |

|---|---|

| Less than $250 | A receipt from the charity that includes the organization’s name, the date, the location, and a description of the donated items. |

| $250 – $500 | A Contemporaneous Written Acknowledgment (CWA) from the charity, which must describe the items and state whether any goods or services were provided in return. |

| $501 – $5,000 | The CWA plus IRS Form 8283, Section A. |

| Over $5,000 | The CWA, IRS Form 8283 (Section B), and a qualified appraisal from a professional appraiser. |

| Over $20,000 (Art) | All of the above, plus a qualified appraisal attached to your tax return. |

This table outlines the documentation required based on the value of your donation.

In addition to these forms, keep detailed records for every item you donate. Include information such as the item's age, condition, original cost, and how you determined its fair market value. For items where condition plays a significant role - like furniture or electronics - take clear photos to document their state at the time of donation. These records not only back up the fair market values you’ve claimed but also safeguard your deductions.

How Deductible.me Simplifies Recordkeeping

Tracking every detail manually, especially when donating multiple items throughout the year, can feel overwhelming. That’s where Deductible.me steps in to make the process easier. The app allows you to snap photos of your donated items and uses AI-powered tools to generate valuations that align with IRS guidelines. It securely stores digital receipts, itemized lists (including condition notes), and creates IRS-compliant reports that are ready for Form 8283 when tax season rolls around.

For just $2/month with the Premium plan, you get unlimited donation tracking and organized receipt management. No more scrambling to reconstruct records at the last minute - everything you need will be neatly stored and easily accessible in one place.

Using Deductible.me for Donation Valuation

Keeping track of donation values by hand can feel like a daunting task. Deductible.me takes the hassle out of the process by automating valuations and removing the guesswork. Here’s how it makes your donation valuation easier and more accurate.

AI-Powered Valuation Features

Accurate valuation is a must for proper tax reporting, and Deductible.me has you covered. Powered by AI, the platform analyzes a photo of your donated item and quickly provides an IRS-compliant fair market value. It pulls data from thrift stores and charity pricing guides to ensure reliable estimates.

Additionally, Deductible.me assigns a standardized condition rating to your item, verifying that it meets the IRS requirement of being in "good used condition or better." This built-in compliance feature helps you steer clear of errors that might draw unwanted attention from the IRS.

Save Time and Stay Compliant

Deductible.me doesn’t just simplify valuations - it also ensures you meet IRS standards without the headache of manual research. With just a few clicks, it generates IRS-compliant reports that are ready for Form 8283. For just $2/month with the Premium plan, you get unlimited donation tracking, advanced receipt management, and secure documentation storage.

Conclusion

Getting your donation valuation right is crucial - not just for staying on the IRS's good side during tax season, but also for maximizing your deductions. The IRS requires you to use the fair market value - what a buyer and seller would reasonably agree upon. If you overstate or understate these values, you could face penalties: 20% for substantial errors and 40% for gross misstatements [1].

To avoid these pitfalls, stick to a structured process. This means documenting the details of each item, researching comparable prices, and adjusting for condition. And remember, the IRS has strict standards for the condition of donated items.

"You can't come up with this value out of thin air. Moreover, because of past valuation abuses by taxpayers, the IRS has imposed special rules for valuing some types of property." - Stephen Fishman, J.D. [5]

This quote highlights why reliable tracking methods are essential. While tracking by hand can be a hassle, tools like Deductible.me make it easy. For just $2/month, it automates valuations, keeps your documentation IRS-compliant, and even generates Form 8283-ready reports.

FAQs

How can I figure out the fair market value of items I want to donate?

To figure out the fair market value of a donated item, start by evaluating its condition - better condition typically means a higher value. Look into recent sales of similar items in secondhand markets or use thrift-store pricing guides. These guides often estimate values at about 30% of the original price for items that are gently used.

For higher-value donations - those worth over $500 or $5,000 (depending on the type of property) - you may need a qualified appraisal, as required by IRS rules.

Make sure to keep detailed records of your donations. This includes descriptions, photos, and receipts, which not only help you stay compliant with IRS regulations but also ensure you can claim the maximum possible tax deductions.

What records do I need for donations based on their value?

The IRS has specific rules for documenting non-cash charitable donations, depending on their value. Here's a quick breakdown of what you need to know:

- Under $250: A receipt or bank statement works just fine. It should include the date, the charity's name, and a brief description of the donated items. Keep this for your records.

- $250–$500: You'll need a written acknowledgment from the charity. This must include the organization’s name, the date of the donation, a description of the items, and whether you received anything in return.

- Over $500: Filing Form 8283 with your tax return is required. Be ready to provide details such as the items' fair market value and condition, along with the charity's written acknowledgment.

- Over $5,000: In addition to Form 8283, you’ll also need a qualified appraisal from a certified appraiser. Keep the original appraisal and attach a copy to your tax return.

- Vehicles, boats, or planes worth over $500: The charity must supply a statement or Form 1098-C, which shows either the sale price or the fair market value. This document needs to be attached to your tax return.

Make sure to keep all your records - receipts, acknowledgments, appraisals, and related documentation - for at least three years. This is crucial in case the IRS decides to audit your return.

How can I accurately value my donations to meet IRS requirements?

To make sure your donation valuations meet IRS requirements, here’s what you need to do:

- Figure out the fair market value (FMV): The IRS defines FMV as the price a willing buyer and seller would agree on without being pressured. To estimate this, rely on sources like resale listings, thrift store price guides, or recent sales receipts. If an item is valued at $5,000 or more, you’ll need to get a qualified appraisal.

- Keep detailed records: Always secure a written acknowledgment from the charity. This should include the donation date, the organization’s name, and a description of the donated items. If your donation is $250 or more, this acknowledgment is a must. For vehicle donations, you may also need to complete additional paperwork, such as Form 1098-C.

- Use the correct tax forms: If your non-cash donations total more than $500, you’ll need to fill out Form 8283 when filing your taxes. For items valued over $5,000, attach a summary of the qualified appraisal. Don’t forget to adjust values for wear or damage, and keep all documentation handy in case of an audit.

By sticking to these guidelines, you’ll not only comply with IRS rules but also make the most of your tax deductions.