How to Track Charitable Donations for Tax Deductions

Tracking charitable donations for tax deductions is all about maintaining proper records to meet IRS requirements. Here's what you need to know:

- Itemize Deductions: You can only claim charitable donations if you itemize deductions on Schedule A. For 2025, the standard deduction is $15,750 (single) and $31,500 (joint).

- Cash Donations: Keep canceled checks, bank/credit card statements, or receipts. Donations of $250 or more require a written acknowledgment from the charity.

-

Non-Cash Donations: Documentation varies by value:

- Under $250: Receipt with charity name, date, and description.

- $250–$500: Written acknowledgment.

- $501–$5,000: Add Form 8283, Section A.

- Over $5,000: Include a qualified appraisal and Form 8283, Section B.

- Over $500,000: Appraisal must be attached to your tax return.

- AGI Limits: Cash donations are capped at 60% of your Adjusted Gross Income (AGI), but excess amounts can carry forward for up to five years.

- Digital Tools: Use apps like Deductible.me for tracking and organizing donations or spreadsheets for manual record-keeping.

Key Tip: Always verify the charity’s tax-exempt status and retain records for at least three years. Proper documentation ensures compliance and maximizes your tax savings.

How to Track Donations in Google Sheets

sbb-itb-e723420

IRS Documentation Requirements for Charitable Donations

IRS Documentation Requirements for Charitable Donations by Value

When it comes to claiming deductions for charitable donations, the IRS has strict rules about documentation. Without the right records, your deductions could be denied[6].

"A charitable gift may be legitimate, but if the taxpayer fails to substantiate it properly, the deduction may be lost." – Scott G. Husaby, Attorney[6]

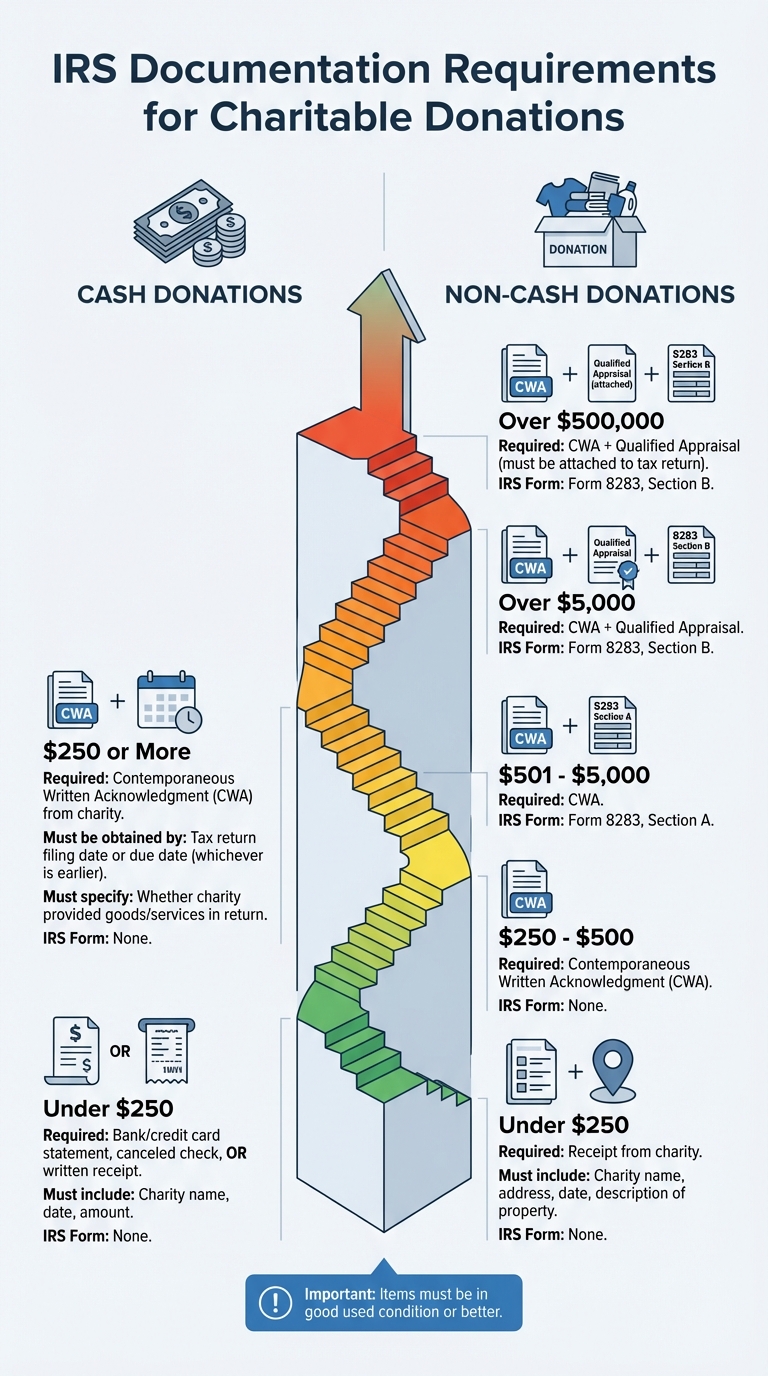

The type of records you need depends on two factors: whether you're donating cash or property, and the donation's value. Here's a breakdown of what you need for each situation.

Cash Donation Documentation by Amount

For cash donations, you’ll need to keep one of the following as proof:

- A canceled check

- A bank or credit card statement

- A written receipt from the charity that includes the charity’s name, the date, and the donation amount

If your cash contribution is $250 or more, a simple bank record won’t cut it. You’ll need a contemporaneous written acknowledgment (CWA) from the charity. This acknowledgment must be obtained by the earlier of your tax return filing date or the due date (including extensions). It should also specify whether the charity provided any goods or services in return for your donation.

Now, let’s look at how non-cash donations are handled.

Non-Cash Donation Documentation by Value

The documentation requirements for non-cash donations depend on their value. Here’s what you’ll need:

- Under $250: A receipt from the charity with its name, address, date, and a description of the donated property.

- $250 – $500: A contemporaneous written acknowledgment from the charity.

- $501 – $5,000: The acknowledgment plus IRS Form 8283, Section A.

- Over $5,000: A qualified appraisal and IRS Form 8283, Section B.

- Over $500,000: A qualified appraisal attached to your tax return.

| Donation Value | Required Documentation | IRS Form Needed |

|---|---|---|

| Less than $250 | Receipt with charity name, date, description | None |

| $250 – $500 | CWA | None |

| $501 – $5,000 | CWA | Form 8283, Section A |

| Over $5,000 | CWA plus Qualified Appraisal | Form 8283, Section B |

| Over $500,000 | CWA plus Qualified Appraisal (attached) | Form 8283, Section B |

For donated clothing and household items, the IRS requires that they be in good used condition or better to qualify for a deduction. If you’re donating a vehicle worth more than $500, your deduction is typically limited to the amount the charity receives when it sells the vehicle. This will be documented on Form 1098-C.

What Information to Record for Each Donation

Keeping track of your donations is essential if you want to claim deductions on your taxes.

"Tracking charitable donations is a practical, year‑round habit that preserves tax benefits and reduces audit risk." – FinHelp.io

The type of information you need depends on whether your donation is cash or non-cash. Here's a breakdown of what to document for each.

Required Information for Cash Donations

When donating cash, make sure to record these details: the charity's name, the date of the donation, and the exact amount you contributed.

If you donate through payroll deductions, keep pay stubs or other records that show the charity's name and the amount withheld.

For donations of $250 or more, you'll also need to note any goods or services you received in return, along with their fair market value. If you donate via text message, your phone bill can serve as proof, provided it lists the charity's name, the date, and the donation amount.

Now, let’s look at what to document for non-cash donations.

Required Information for Non-Cash Donations

For non-cash donations, be sure to record:

- The charity's name and address

- The date and location of the donation

- A detailed description of the items

When donating clothing or household goods, remember that items must be in "good used condition or better," as the IRS won’t allow deductions for items in poor condition.

You’ll also need to determine and document the fair market value of each item. This is the price a buyer would pay a seller, assuming both parties are informed about the item. To back up your valuation, you can use thrift store pricing guides or check online sales for similar items.

For added proof, take dated photos of the items to show their condition and existence.

If your total non-cash donations exceed $500, you’ll need to include extra details, such as how and when you acquired the items and their original cost. For items worth more than $5,000, you’ll also need a qualified appraisal to support your claim.

How to Organize Donation Records with Digital Tools

Choosing the right system to manage your donation records digitally can simplify your life. These tools can help centralize receipts, track values, and ensure you're ready when tax season rolls around.

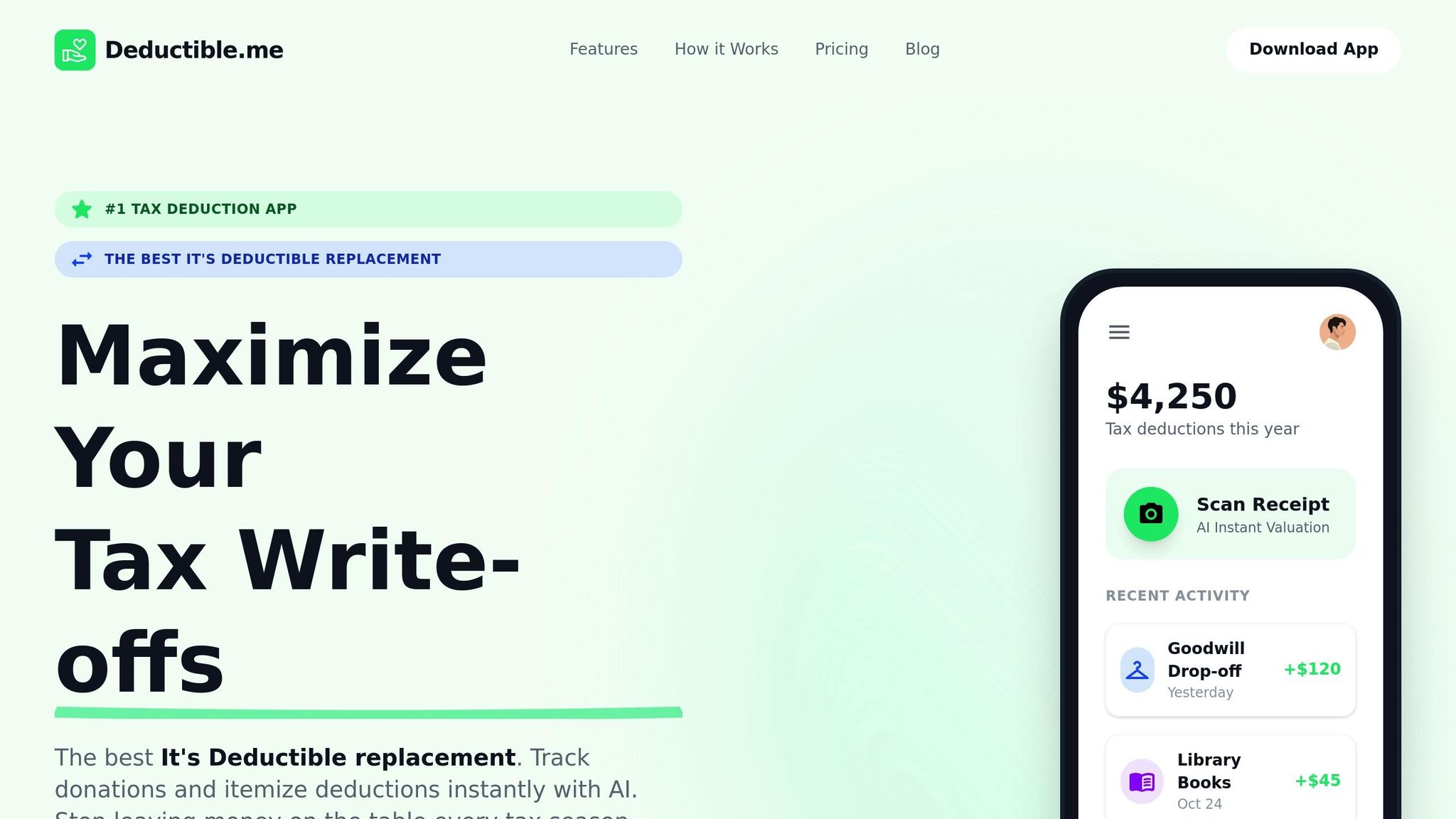

Track Donations with Deductible.me

Deductible.me leverages AI to make donation tracking straightforward. When you donate items like clothing or household goods, just snap a photo through the app, and its AI will calculate the fair market value for you. The app also generates IRS-compliant reports, including Form 8283 for non-cash donations over $500, saving you from doing manual calculations and reducing the risk of missing documentation.

The free plan lets you track up to $500 in donation value and offers basic receipt tracking. For $2/month, the Premium plan provides unlimited tracking, advanced receipt management, and tools to set and monitor annual giving goals. All your records are securely stored, so pulling up your complete donation history for tax filing is quick and easy.

Use Spreadsheets and Cloud Storage

Prefer a hands-on approach? Spreadsheets are a great way to manually track your donations. Set up columns for details like Date, Charity Name, EIN, Amount or Description, Donation Type (cash, stock, in-kind), Receipt Attached (Y/N), and Form 8283 Required (Y/N).

Pair your spreadsheet with cloud storage to keep digital copies of receipts and photos. Use a consistent naming format, such as Red Cross - 2025-03-15 - $500, and organize files into folders by tax year (e.g., "Taxes/Charity/2025/"). To stay on top of things, set a quarterly reminder to reconcile your spreadsheet with your bank and credit card statements. This way, you can spot and fix any missed transactions well before tax time.

Next up, dive into how to complete IRS Form 8283 for non-cash donations over $500.

How to Complete IRS Form 8283 for Non-Cash Donations Over $500

Once you’ve organized your records, here’s a guide to completing IRS Form 8283 for non-cash donations totaling more than $500.

When Form 8283 Is Required

You’ll need to file Form 8283 if your total non-cash donation deductions for the year exceed $500 [9]. This applies whether it’s a single high-value item or multiple smaller items that, together, cross the threshold.

The IRS has a “similar items rule,” which means you must group donations of the same general type - like clothing, books, electronics, or jewelry - to determine if the $500 limit is met [9]. For instance, if you donated $300 worth of clothing to Goodwill in March and $250 worth to the Salvation Army in October, your combined total of $550 requires Form 8283.

"The IRS may disallow your deduction for noncash charitable contributions if it is more than $500 and you don't submit Form 8283 with your return." - Taxpayer Advocate Service [1]

Section A is for items valued between $501 and $5,000, such as publicly traded securities or qualified vehicles, regardless of their value [9]. Section B is for items or groups of similar items with deductions over $5,000 and requires a qualified appraisal signed by a professional appraiser [9].

Steps to Fill Out Form 8283

Follow these steps to ensure accurate completion of the form. First, determine whether Section A or Section B applies based on the value of your donation.

For Section A, you’ll need to provide the following details:

- The charity’s name and address

- A detailed description of the donated property (e.g., "Dell laptop, Model XPS 13")

- Dates of donation and acquisition

- How you acquired the item (e.g., purchase, gift, inheritance)

- The item’s cost or adjusted basis

- Its fair market value [9]

Pay close attention to the "Basis" column. The IRS has denied deductions in cases where this section wasn’t properly completed [8]. If you can’t determine the basis (e.g., for inherited items), include a statement explaining why [9].

For Section B, you’ll need a qualified appraisal dated within 60 days of the donation. If your deduction exceeds $500,000, the appraisal must be attached to your return [8][2]. Additionally, the appraiser must sign Part IV, and a representative from the charity must sign Part V [9].

For vehicle donations over $500, complete Section A and attach Form 1098-C or a written acknowledgment from the charity [10]. If you’re filing electronically, scan the signed Form 8283 as a PDF or mail it along with Form 8453 [9].

How to Maintain Donation Records Over Time

Keeping your donation records organized digitally is a great first step, but maintaining them over the years is just as important. This ensures you're prepared for audits and can file taxes accurately.

Record Retention Timeline

The IRS has specific guidelines for how long you should keep donation records, depending on your filing situation:

- At least 3 years from the date you file (or 2 years from the payment date, whichever is later) for most charitable deductions [11][12].

- 6 years if you omit income exceeding 25% of the gross income reported on your return [11][12].

- Until property disposition for any property donations [11][12].

- Indefinitely for fraudulent or unfiled returns [11][12].

"Generally, you must keep your records that support an item of income, deduction or credit shown on your tax return until the period of limitations for that tax return runs out." - Internal Revenue Service [11]

Once you've established your retention timeline, make sure your records are securely stored and align with your tax documentation.

Match Donation Records with Tax Returns

To stay organized, structure your records so they match the details on your tax return. This means aligning donation receipts, bank statements, and acknowledgment letters with the entries on Schedule A (Form 1040). For every donation listed, ensure you have the proper documentation - like written acknowledgments for contributions of $250 or more, or bank statements for smaller cash donations.

"Well-organized records make it easier to prepare a tax return and help provide answers if your return is selected for examination or if you receive an IRS notice." - Internal Revenue Service [12]

What to Do When Receipts Are Missing

If you've misplaced donation receipts, there are other ways to verify your contributions. Acceptable alternatives include:

- Bank statements

- Canceled checks

- Credit card statements showing the charity's name, date, and amount [2][4]

- Telephone bills for text donations [3]

- Payroll deduction records, such as pay stubs or W-2 forms [4][3]

For donations of $250 or more, you can contact the charity directly to request a replacement acknowledgment letter [2][4]. If you've made non-cash donations exceeding $500, be sure to fill out Form 8283, providing detailed descriptions and fair market value estimates [2][1][7].

Conclusion

Keeping accurate records of your donations is essential for securing tax deductions and staying prepared for any IRS review. Without the right documentation, the IRS can reject your deduction entirely. Even worse, if you miscalculate the value of non-cash donations, you could face penalties of 20% or 40% on any underpaid taxes[5].

To avoid these pitfalls, make sure to record key details at the time of each donation. This includes the charity's name, the date of the donation, the amount donated, and the fair market value of any non-cash items. Tools like Deductible.me can simplify this process by centralizing your records, tracking IRS thresholds, and even preparing Form 8283 when your non-cash donations exceed $500.

Keep in mind that charitable deductions are generally capped at 60% of your Adjusted Gross Income, though lower limits - 20%, 30%, or 50% - may apply based on the type of organization or gift[5]. Staying on top of your records not only helps you claim the maximum deductions but also ensures you comply with IRS guidelines. Don’t forget to account for out-of-pocket volunteer expenses, like the 14 cents per mile you can deduct for driving to charitable events. These small details can add up over time and boost your deductions[13].

Whether you rely on Deductible.me's AI-powered tracking or stick to a well-organized spreadsheet, always verify each charity’s tax-exempt status using the IRS TEOS tool. Be sure to keep your records on hand for at least three to seven years[13].

FAQs

What documentation do I need for cash donations of $250 or more?

If you contribute $250 or more in cash to a charity, you'll need a written acknowledgment from the organization to claim it as a deduction on your taxes. This document should include:

- The exact amount you donated

- The date of your contribution

- A statement indicating whether you received any goods or services in return (and, if so, a description of them)

Be sure to secure this acknowledgment before filing your taxes and keep it with your records to meet IRS requirements.

How can I figure out the fair market value of items I donate?

To figure out the fair market value of your non-cash donations, think about what a buyer would reasonably pay a seller for the item as it is now. You can look at comparable sales, browse online listings, or, if needed, get a qualified appraisal. According to IRS rules, an appraisal is required for items valued over $5,000 or certain types of property. Make sure to keep detailed records of how you determined the value to comply with tax regulations.

What can I do if I misplaced a receipt for a charitable donation?

If you've lost a receipt for a charitable donation, there's no need to panic - you still have options to document it. Begin by reaching out to the charity and asking for a replacement acknowledgment. Most organizations can issue a new receipt with all the required details.

If getting a replacement isn’t an option, you can rely on alternative records to verify your donation. These might include:

- Bank or credit card statements that show the transaction

- Canceled checks

- Other paperwork that clearly states the donation amount and date

Make sure to keep these records well-organized and ensure they align with IRS requirements for proper documentation.